Rooting out career criminals is taking on a whole new meaning with more businesses now resorting to polygraph testing to get to the bottom of workplace crime as well as to identify would-be trouble makers before they are even hired.

Willem Marshall, a polygraphist with national private investigation agency, Justicia Investigations, warns that far too many employers are naïve enough to believe that theft, fraud and corruption will never surface in their companies. “People need to realise that there is more and more organised crime out there and that they are being targeted.

Syndicates often infiltrate organisations by either arranging a syndicate member to be employed there, or more often, buying over a current employee who might have a clean track record up to that point. Intelligence is everything and criminals share information. Our experience shows that a high percentage of company crime is perpetrated by employees or in collusion with employees.”

According to the South African Police Services (SAPS), commercial crime in South Africa has increased by 42,7% since 2007. Statistics South Africa notes that ordinary employees are involved in 75% of fraud and corruption in local companies.

During his 14 years in the South African Police, where he rose through the ranks to become commander of the Hillcrest detective branch as well as during many years of specialist training, Marshall says that he came to realise that polygraphing was both the most misunderstood and the most useful tool that business owners could use when it comes to getting to the root of problems.

This is underscored by colleague and fellow polygraphist, Frans van Biljon, whose 12 year career with SAPS as a captain in the forensics field saw him trained by the SA Criminal Bureau. Both were also trained by the American International Institute of Polygraphs and completed their training programme for Psychophysiological Detection of Deception.

Fear factor

Van Biljon says that far more people pass polygraph tests than fail – and before even taking a test, up to 80% admit to a misdemeanor. This ‘fear factor’ – a reaction to the unknown – extends way beyond employees to employers themselves. Even today, many are scared to use polygraph testing, feeling this could impact negatively on staff morale.

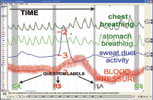

However, a workplace polygraph test is nothing like the feared or scorned ‘lie detector test’ depicted in movies and on television crime channels. Instead, it is a sophisticated system that brings together a parcel of issues that include not only the graphs and charts produced by the computers to which candidates are connected but also a host of verbal and non-verbal communications.

'Not admissible in court' is the most common retort received when Marshall and van Biljon are called in. However, once again, it is not that simple. Although a polygraph test alone is not accepted by either criminal or industrial courts in South Africa, there have been many cases where court decisions have been swayed by the outcome of a polygraph test.

The other side of the equation is that “the innocent guy must have a platform to prove his innocence” and a polygraph does just this, says van Biljon. “We often go to the CCMA to defend people who have passed tests. At the end of the day, integrity is all important.”

Separating the blameless from the suspicious also makes investigations easier and less traumatic for all. “If you are dealing with a warehouse in which around 50 people work, where do you start? It is nonsensical to conduct an in-depth investigation on all 50. This would not be practical or cost effective, so the best place to begin is by eliminating the innocent,” Reg Horne, MD, points out.

He recalls a case where contractors on a construction site had been implicated in the theft of cellphones, jewellery and other electronic goods. “Our client requested that polygraphs be conducted on the contractors. All of them passed the test. It was later found that the missing property had been misplaced.”

Pre-employment screening

While just 10% of our clients considered pre-employment polygraphs five years ago, up to 60% are now using this method of screening employees, especially in high risk areas such as banking, security, insurance, logistics, construction, manufacturing, hospitality industry and retail, he adds.

Van Biljon says many casinos screen their croupiers and polygraph tests are also used by entertainment venues to ensure that employees such as bar tenders or waiters do not spike drinks.

According to Van Biljon, when screening employees for security companies, a very low percentage of candidates actually pass polygraph tests. “A well known security company that uses Justicia to conduct pre-employment polygraphs had checked an applicant for a criminal record using his ID number. He came back clean and all his references checked out. However, he failed our polygraph test. Upon investigation it was discovered that the applicant had used a false ID number and had pre-planned all his references. We also discovered that he was actually out on parole and was a well-known criminal.

“The position for which this person had applied was in the control room which is the communication hub for any security company. Not discovering this information could have led to the leaking of crucial and confidential information such as alarm details, codes, addresses as well as details of when property owners were away. He could also have manipulated alarms and reaction times, allowing thefts to take place while covering up for the syndicate for which he was working.”

Van Biljon says that polygraph tests do not just uncover major crimes. They often pick up drinking and drug related problems which could be catastrophic when employing somebody in a responsible position. “The most important thing to remember is that the ability to steal once, if left unchecked, could lead to an employee committing more serious offences in the longer term.”

Transport success

Van Biljon and Marshall say that one industry where polygraphs have proved particularly effective both before signing employment contracts and during investigations has been in the trucking industry.

“Syndicates operate extensively in this sector, attempting to bribe and intimidate drivers and their assistants to get their cargo. Often hijackings reported are actually handovers. Polygraph tests conducted on drivers and their assistants look at all the different versions of the so-called hijacking. In some cases, we find that the driver is involved in the syndicate. As a result, we have recovered millions of rands worth of stock,” says Marshall.

He explains that Justicia dealt with one driver who had apparently been hijacked seven times. When applying for his job, he had told his prospective employer that his contract had expired. A pre-employment check might have identified that he had actually been dismissed.

Horne says that some employers are now taking pre-employment screening a step further by doing periodic polygraph testing on either a routine or random basis. Again, this applies to high risk operations and acts as a deterrent. While some businesses polygraph all employees at defined periods, others select random groups. He says this not only inculcates a culture of honesty and accountability but is also often welcomed by employees as a means of preserving their credibility.

He suggests that the need for employees to undertake polygraph tests both periodically and as part of in-house investigations should be written into employment contracts as a condition of employment. “More and more people are seeing polygraphs as a normal part of the employment process much like an annual medical. I do not recall one person who has not come back for the next test,’ he says.

Polygraph tests are completely voluntary and an employee has to give written consent. Van Biljon explains that preparing examinees for a test involves explaining their rights, showing them how the polygraph equipment works, discussing health issues and discussing questions upfront to dispel nervousness.

He says questions related to a particular investigation or those needed to screen applicants for jobs are pre-prepared according to each client’s needs. During the test itself, these questions are interspersed with general or unrelated questions.

For more information contact Justicia, +27 (0)31 308 0600.

© Technews Publishing (Pty) Ltd. | All Rights Reserved.