Over the past decade, a lot has changed in the physical security market. Faced with challenges such as increasing crime rate and terrorism, security has become a top priority for everyone. People, governments, and industries are all exploring opportunities to invest in advanced security solutions.

Among the various security solutions, video surveillance is the most widely deployed. It has become an essential component of an effective security system. With IP and wireless technologies gaining popularity and acceptance, the video surveillance market is witnessing a dynamic change. In fact, ARC Advisory Group research indicates that these technologies are two of the major factors contributing to increased acceptance of IP technology. Use of video analytics with IP cameras is one major benefit over traditional analogue cameras.

Video analytics

Video analytics software analyses camera images to detect and report suspicious activities. The various analytics functions include motion detection, congestion detection, object detection, theft detection, counter flow, virtual trip wire, and licence plate recognition. When provided by well-established suppliers, the more mature and time-tested functions – such as motion and licence plate recognition – tend to be very reliable, with minimal chances for false alarms.

In contrast, analytics such as face recognition are very complex and the technology is still in infancy, so reliability is a concern for many users. Frequent false alarms from complex analytics systems are a major problem. Every alarm requires human attention, so it is very important to keep false alarms to a minimum. If generated too often, false alarms can make the system completely ineffective since the operator will become tempted to either ignore the alarm or turn off the expensive system completely.

Another problem with video analytics systems is high maintenance. Video analytics technology is in infancy and depends on IP technology, which itself has reliability issues. Security personnel, which generally realise most of the benefits, often do not have a good understanding of IP. The technology requires extra effort to deploy and maintain. To maintain IP-based security systems, security departments need support from IT departments.

Furthermore, changing weather and other conditions can affect the performance of analytics systems adversely and systems will require additional maintenance. High false alarm rates and infrequent maintenance can lead to underutilisation of a company’s video analytics system and undermine the significant initial investment required to implement the system.

High cost of these intelligent video surveillance systems is another big issue. IP cameras – on average – cost twice as much as analogue cameras, wireless IP cameras are even more expensive (although installing these cameras is significantly less costly), and analytics software is expensive. To implement intelligent video surveillance, end-users have to spend extra money on both analytics software and IP cameras. This can nearly triple the investment compared to non-intelligent systems using analogue cameras. Moreover, since the technology is relatively new and somewhat unproven in the field, users can be reluctant to invest heavily in it.

Many users have very high expectations for analytics. They deploy intelligent video surveillance solutions hoping to remove human operators completely. While video analytics technology is not yet sophisticated enough to eliminate human involvement, it can decrease dependence on humans and make the surveillance more effective. Operators cannot monitor many screens at the same time for many hours with a high degree of effectiveness, so suspicious activity could go unnoticed.

Moreover, many companies cannot afford to pay security personnel to sit and watch a wall of video screens 24 hours a day, seven days a week. When video analytics systems are integrated with an alarm notification tool, organisations can reduce their personnel costs. Operators are notified of events that require human attention, leaving them free to engage in other activities when there is not an alarm and quickly prompting them to action when an alarm is triggered. So even if the alarm rate is higher than desired, analytics have the potential to make surveillance more effective and less cumbersome.

Slow adoption

From a global perspective, the economy remains very fragile and, as the European sovereign debt issues illustrate, the global economy teeters between recovery and recession. Any negative economic event threatens to tip the world economy quickly back into recession. Faced with heavy budget cuts, companies are hesitant to invest in IP, wireless, and wireless IP technologies. Many companies are keeping very large amounts of cash on their books – instead of making investments – due to concerns that the global economic prospects will deteriorate further.

In brownfield projects, integrating analogue and IP-based systems is challenging. As a result, IP is more appropriate in greenfield projects where users are not tied to legacy systems. But in today’s weak economic climate, new construction projects are rare, resulting in slow adoption of IP technology.

With the ever-increasing need for better security, the physical security market demands innovation. The economic situation has caused large companies to keep more cash on their books and pay less attention to R&D. No doubt, video analytics and wireless IP technology have great market potential, but innovation in this segment has lagged in the last couple of years due to adverse economic conditions.

The current situation has left market participants divided into three groups. One group consists of the proponents of video analytics, which obviously include suppliers of analytics solutions and those users that have reaped benefits from the technology. Another group is composed of opponents, including both users that have invested heavily in analytics, but with disappointing results, and those that are familiar and comfortable with analogue technology and see no need to change. A third and, by far, the largest group is composed of people that understand the potential benefits, but are not yet ready to invest in wireless IP-enabled video analytics due to several concerns, including reliability, cost, and the perceived learning curve to become comfortable with the new technology.

The future of analytics and IP

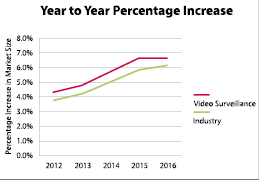

ARC Advisory Group research indicates the highest growth for video surveillance in the physical security industry. According to our analysis, IP cameras will enjoy higher percentage growth compared to analogue cameras, but volumes will remain relatively small in the medium term. As organisations deploy more and more IP-based solutions over time, software revenues will increase significantly for suppliers of video surveillance systems. We also expect demand for analytics software to grow significantly. For both – buildings and industry – ARC anticipates above-average growth for both analytics and IP.

Video analytics have great potential, but end users need to understand the limitations and should not have unreasonably high expectations. While analytics cannot eliminate human involvement, they can help reduce workforce requirements and costs and increase video surveillance effectiveness. Overall, the future for both wireless IP cameras and analytic software looks bright. As more and more people adopt IP, demand for analytics will also increase significantly. How soon analytics will be able to remove human involvement completely depends on successful innovation. Considering the current pace of innovation in this industry and overall economic trends, it is safe to say it will take a while for that to happen.

ARC’s Physical Security and Access Control for Industry (securitysa.com/*arcweb-industry) and Physical Security and Access Control for Buildings (securitysa.coom/*arcweb-buildings) market outlook studies also provide in-depth information about market forecast, growth, strategies, and technology information.

For more information contact Joe Gillespie, [email protected], www.arcweb.com

© Technews Publishing (Pty) Ltd. | All Rights Reserved.