A practical analysis of the management of cash within the South African retail sector presented at the third Cash Handling and Security Forum, Johannesburg on 28 October 2009 by Richard Phillips, MD of Cash Connect Management Solutions.

The environment

* Business robbery is up 41%. 13 920 incidents or 38 robberies a day in the past 12 months.

* 45% or more of all payments for goods and services are paid for by cash.

* Cash is the target in over 95% of armed robberies in the South African retail sector.

* Over 90% of armed robberies against businesses in South Africa are executed with the insider participation of one kind or another.

So if you do not closely protect and manage your cash, you will not only lose vital income and often critical cash flow, but you run the risk of having to deal with blood on your counters and death on your floor.

Traditional cash management processes

The cash management process in a retail environment starts with the customer who pays the cashier in cash for the goods or services purchased. The cash is counted out by the customer and counted into the till drawer by the cashier. Cash accumulates in the till drawer during the course of the trading day or until the cashier removes it and takes it to the back of the store where it passes over to a third party. In larger stores the third party could be a supervisor while in many smaller businesses it is often the owner or manager.

At this handover, the cash is counted once again as it transfers from the cashier to the supervisor and a receipt is issued to the cashier for the till drawer.

The transfer of cash between cashier and the supervisor can occur on multiple occasions during the trading day depending upon how many cashiers operate in the store and how often each till drawer is cleared. The cash from each of these transfers will be placed somewhere ready for when the supervisor prepares a bank deposit. Somewhere can be anything from a safe to a paper bag lodged on the shelf in the storeroom where no-one knows about it.

At some point in time in the day the supervisor and/or owner or manager will bring all the cash handed to him/her to a central place whereupon a bank deposit is prepared. On this occasion and if the sorting of denominations has not been done, the bank notes are sorted and bundled by denomination, the amounts entered into a bank deposit slip and the entire deposit counted again.

Once the bank deposit has been prepared, it is placed into a container ready to send to the bank. In most cases the business contracts an armoured car company to collect the cash and take it to the bank. Unfortunately, however, in many cases, the business sends the deposit to the bank with a staff member or by the owner and/or manager.

Once the container arrives at the bank, the container is opened by a bank teller and the contents counted again and verified against the deposit slip before the value is finally credited to the bank account of the business.

The risks associated with the process can be summarised as follows:

The store’s exposure to violent, armed robbery is increased directly proportionate to the amount of readily accessible cash either in the tills or in the back office or both.

The cash is counted between five and eight times from the moment it is given to a cashier by a customer until it is verified at the bank. The bank treats its count as final and will generally not entertain claims arising from alleged discrepancies in the deposit. The national average loss arising from shortages between cashier and bank varies between 0,15% and 0,2%.

The risk of robbery between the store and the bank is significant where the business does its own banking. The debate is not about if, but rather about when the attack will occur.

Cash crime has shifted to the business sector

Over the past 18 years the significant and alarming growth in cash crime has dominated the media and has had a profound impact on our lifestyle, business and our economy. People are injured or killed as a result of armed robbery almost every day in South Africa.

The recently published crime statistics reflect the ever increasing capacity of the cash in transit companies to protect themselves and their cargo against criminal activity and their success manifests itself in the growing number of armed robberies being experienced within the retail sector.

An analysis of a participating representative sample of the retail sector supplied courtesy of the Consumer Goods Council of South Africa illustrates the year on year increase in all the measured segments of attacks on stock, tills, cash offices and safes. The high number of attacks on safes could be misleading because of what are defined as safes. A great many of the devices that are loosely described as safes are in fact steel boxes that do not conform to SABS standards for a safe. This includes a number of the automated bank note acceptance devices that are available on the market.

SABS certified cash vaults

The South African Bureau of Standards publish a standard SANS 751: 2008 version 5, which prescribes what is deemed to be a minimum requirement for various levels of safes. These range from a category one level to a category five level of protection defined by the length of time it takes for illegal access to be gained using tools such as an angle grinder to oxy-acetylene cutting devices.

Cash acceptance devices that are not certified SABS category safes have been increasingly targeted in hit and run armed robbery attacks because of the ease with which they can be opened or uplifted. By way of example, a burglar-resistant safe of category 2 classification complies when it can resist a hand tool attack for a net working time of 30 minutes.

Conversely a Category 3 safe is compliant if it can resist successful entry for a net working time of 60 minutes when tested in accordance with either and/or hand tools, an electric disc cutting machine and/or an oxy-acetylene cutter.

Although often aesthetically pleasing, devices built of between 6 mm and 8 mm steel housing are easily removed and simply cannot and do not offer any deterrent against hardened criminals. Counter top mounted machines are readily ripped off their mountings and stolen within minutes. Free standing machines that can be cut open with angle grinders in less than 5 minutes do not provide the retailer with any protection against a hit and run armed robbery attack.

Where such devices have the capacity to hold between 5000 and 10 000 bank notes, the attractiveness of the target is greatly enhanced by the increased reward of R600 000 and more, and are an open invitation for attack in broad daylight.

A SABS categorised safe of a level 3 or above will weigh 650 kilograms or more and should be bolted into a concrete floor. It cannot readily be removed and carried away and would require anything up to three or more hours for it to be cut open to the extent that the contents can be reached.

In short, if it is not a categorised safe, it is not a deterrent against hit and run armed robbery.

Through-the-wall drop safe systems

While on the subject of safes, I would like to address the question of through-the-wall, drop safe systems. These units have been traditionally built of 6 mm steel housing fitted with a category 2 ADM safe door and are for the most part built through the wall under the armoured pay windows on fuel station forecourts. The Category 2 door faces the outside of the building onto the forecourt from where the security guard is required to clear the contents in the open and with his back fully exposed to an attack from behind. Moreover, the dropcash works with a metal container, which has no form of protection and is thus an attractive target for robbery even by amateurs. It is because of the relative ease with which these boxes can be stolen that the extent of the exposure to which the guards find themselves when clearing these devices, coupled to the extreme unpredictability of insecure, amateur and armed criminals, that over the years these systems have attracted the highest number of successful robberies with the greatest number of fatalities over all other operating environments within the CIT logistics chain.

It is also a fallacy to believe that by keeping the security staff outside of the business, the potential for armed robbery will be reduced. History shows quite the opposite. The reality is that the maxim out of sight is out of mind is a much more prudent and appropriate principle to be adopted when designing a cash collection space.

Cash containers

This leads us to the question of cross-pavement containers and their design to withstand both internal theft (skimming) and cross-pavement robbery. The former can more often be much more costly than the latter because of the very surreptitious and repetitive nature of the theft and the difficulty of determining when and by whom the theft took place.

The use of tamper evident bags by leading cash in transit companies worldwide, including the RSA and for over 15 years is not a co-incidence. Tamper evident bags have proved to be the most effective means of moving cash between customer and bank because any attempt to skim from the contents is readily evident to the naked eye. Because the bag is receipted when transferred between any two custodians, the opportunity to apportion responsibility to the custodian under whose control a tampered bag is found, is both easy and provable.

Secondly, the equally universal use of cross-pavement carrier boxes designed to carry the tamper evident bags has proven to be the most successful deterrent to armed robberies across the pavement. The CPC is equipped with dye staining systems that when attacked, activate and indelibly stain the bank notes. The bandits know how the box works and unless completely ignorant of its workings, generally avoid attacking the cash on the pavement.

Any retail cash automation system that makes use of unprotected containers such as a cassette or a re-usable canvas bag does not provide the same level of protection as the tamper evident bag and remains exposed to both cross pavement as much as the internal loss. Moreover the higher the value carried within these containers, the more attractive they become to armed attack.

Once the tamper evident bag reaches the protection of the armoured vehicle vault, it is removed from the cross-pavement carrier and dropped into an onboard drop safe. Cassettes and canvas bags on the other hand have to be left on the vault floor. When armoured vehicles are attacked it is the cash left exposed on the vault floor that becomes the obvious target.

Cash handling automation

In recent times the arrival of cash acceptance systems in South Africa have introduced the opportunity for the retailer to reduce his costs of cash management and significantly improve his risk profile both within the store and whilst in the custody of the cash in transit carrier. However it is important that the technology used by the cash solutions provider conforms to the best practices as discussed above. In summary the cash acceptance devices must be housed within a minimum of a SABS certified category three or more construction and the cash container must be a sealable bag that is compatible with the CIT cross pavement and in vehicle security requirements.

If the technology does not conform to the specifications that have evolved in South Africa from the past 20 years of hard earned experience then it is unlikely that it will stand up to the rigours of the criminal environment it is required to perform in.

An early warning as to the effectiveness of a supplier’s technology should be when the supplier is unable or unwilling to include insurance in its offering and requires the client to secure his cash risk himself.

The cash acceptance device is linked to the service provider’s mainframe by a GPRS link that allows for the constant monitoring of the technical well being of the machine as well as each and every deposit that is made into it.

It goes without saying that if all of this information is available then it should be presented in a user friendly format for the retailer. In addition to access to the safe’s activity on a realtime basis via a web-based customer portal, leading service providers offer a variety of reports with which to alleviate the need of manual and duplicated record keeping.

Typical examples of reports would be inter alia, the daily bag closure report, settlement reconciliation report and historic record of deposit activity right down to individual cashier level.

The cost of managing cash

The cost of managing cash is generally not fully understood as the elements that contribute can be hidden. So when the costs of introducing an automated solution are weighed up against what the retailer thinks his costs are, a like for like comparison is not always possible.

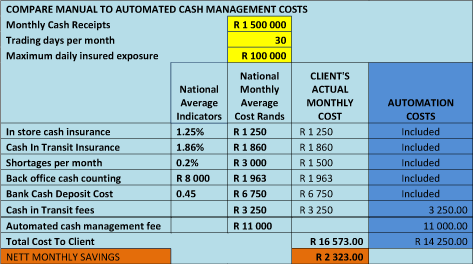

The following table of indicative costs are based on a business that processes R1, 5 million in cash over a 30 trading day month:

The cost of in store cash insurance averages out at 1,25% of the maximum value insured per event. Assuming that the maximum value is R100 000 at any one time the cost is about R1250 monthly.

Many people believe that the fees they pay the armoured car company includes insurance against the loss of the money whilst in the care of the carrier. However, this is more often not the case. The cash in transit companies contractually undertake to assume fidelity liability under circumstances of gross negligence and the extent of the liability is capped. Unless the customer specifically purchases insurance against any form of loss and for a fee over and above the service fee, no such cover exists.

The national average cost of cash in transit insurance is 1,86% of the declared maximum value per event. In the case in point, this would amount to R1860 per month.

The national average for shortages that arise anywhere between the receipt of cash at the till and the receipt of the store’s deposit at the bank is 0,2% of monthly turnover. In the case in point, I have reduced this average to ,1% on cash receipts or R1500 per month.

Whether the back office counting and reconciliation of cash is a function of a member of staff or by the manager/owner, there is a cost that is attributable to this task. In my experience a medium to small business will spend around 17 hours a week counting cash. In the case in point we assume a staff member on a salary of R8000 per month and allocate 17 hours per week at a cost of R1963 to cash management monthly.

Finally cash deposits of R1,5 million can attract a bank deposit fee which varies depending upon the size of the company the retailer belongs to and the importance a particular bank attaches to that company. In our case in point a middle of the road rate for a single trader of R0,45cents/R100 or R6750 monthly has been applied.

A cash in transit contract will vary greatly from one company to another and one area to another but for purposes of this case I have assumed an average 6 x weekly collection rate of R3250.

The total cost of managing cash is thus R16 573 a month or 1,1% of cash receipts or 0,7% of total turnover.

This compares favourably to European studies where retailers spend anywhere between 0,5% and 1,5% of turnover managing their cash. The variance is dependent on the kind of store as well as the size of the store. The larger the store the smaller the percentage. The average for the Western European market is 1%.

The comparative cost of managing cash using an automated cash management service provides a saving for the retailer which in this conservative example amounts to R2323 per month. And this does not take into account the massive improvement in the retailer’s risk profile once a system of this kind is commissioned.

In closing I wish to stress that as long as the solution meets the minimum criteria as highlighted in this presentation, the benefits to the retailer are significant and can be summarised as follows: The removal of the main reason for armed robbery

1. Elimination of shortages once the cash is deposited.

2. Reduces back office overheads and time

3. Insures the cash from safe to bank including whilst in transit.

4. Transfers value electronically to bank account same day

5. Provides full financial reporting reducing dependency on back office bookkeeping

6. Saves money

The only effective way to reduce armed robberies in the South African retail sector is to make the cash inaccessible. Automation of the cash management process using technology and systems that conform to tried, tested and proven cash protection and logistics principles offer a cost effective way to remove the cash risk from the retailer.

© Technews Publishing (Pty) Ltd. | All Rights Reserved.