At its heart, the retail industry is all about the efficient management of time and money. It’s about offering customers choice in payment method while securely managing the cash that flows into the retail store. It’s about quick access to working capital necessary to pursue trading opportunities as they arise. And it’s about finding new ways to improve profit margin and increase revenues.

According to Steven Heilbron, CEO of the Connect Group, retailers have a key role to play in rebuilding the economy in the wake of the devastation of the COVID-19 pandemic. However, to succeed in these difficult operating conditions, small- and medium-sized retailers need to improve efficiencies, streamline cash flow and exploit new revenue streams.

It is the mission of the Connect Group to enable retail merchants with innovative, tech-driven solutions focused on efficient cash management, access to capital, card payment solutions and prepaid value-added products and services. “By harnessing smart and secure technology, retailers can boost their operating efficiency, reduce costs and safeguard their business,” says Heilbron. “Of course, it’s critical to put in place systems, technology and adhere to strict security compliance standards in order to protect physical money and data alike. This gives our clients the peace of mind that their cash is secure and that their customers can transact with peace of mind.

The Connect Group addresses these needs through four main offerings.

Cash Connect offers an end-to-end cash management solution that is pretty much like putting the bank in a retail store. This solution encompasses a robust and automated cash vault, cash-in-transit logistics, cash processing, instant access to cash in the vault and ensuring a safer trading environment. Cash Connect manages more than R100 billion a year on behalf of its diverse retail customer base and is an approved service provider to retail leaders such as Spar Group, Shell, Engen, Pick ‘n Pay and OK.

Cash Connect is South Africa’s leader in automated cash management and payment solutions, with technology that has been proven to be the most effective deterrent to criminal attacks in the local retail market. Its automated cash vaults are built to minimum SABS category 4 standards. From the moment the cash is deposited into the cash vault, while in transit and until it reflects in the retailer’s bank account, Cash Connect carries the risk and guarantees the funds in the retailer’s bank account.

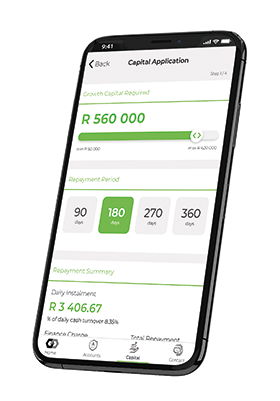

Capital Connect is a fintech solution designed to provide retailers with quick access to trading capital by allowing them to apply for business funding right from an app on their smartphone. An unsecured business loan can be obtained within 24 hours, meaning retailers can capitalise on time-limited opportunities such as bulk pricing promotions from suppliers because they can raise the necessary funding, hassle-free.

Card Connect provides mobile and countertop card acceptance devices for established and informal retail markets – providing retailers with card payment machines that have tap-and-pay/contactless payment functionality. They also allow for cash withdrawals at point-of-sale (POS) with a card transaction. Customers don’t have to leave the store to go to an ATM, driving footfall, convenience and loyalty.

Kazang Connect makes it safe and simple for spaza shops and formal retail merchants to sell prepaid products and services from its mobile app and POS terminals. This can help them to attract and retain customers by offering convenient value-added services, as well as to generate additional revenues and boost cash flow.

“Our Fintech business solutions open doors for retailers, enabling them to grow and thrive. We are constantly expanding our set of solutions with the right security compliance, ensuring all data is secure and encrypted throughout each process of our offering and equally important, to help SMEs maximise their business potential. Whether that is achieved through smart retail cash management, quick access to working capital or value-added products and services that give their customers that extra edge of convenience,” concludes Heilbron.

Find out more at www.connected.co.za

© Technews Publishing (Pty) Ltd. | All Rights Reserved.