The process of screening employees before employment is not new, but it is a discipline that has expanded over time to include a variety of areas of background checking. In the age of social media, an age in which people are continually surprised that their public posts are actually public and available for the world to see, analysing a person’s Twitter or LinkedIn profiles can provide in-depth insights into the individual that won’t normally be self-evident when meeting them. On social media, it seems, nobody is on their best behaviour.

The catch with employee screening is that it costs money. The more information you require, the more it costs. Some employers don’t consider the cost worth the effort, but there are others, a growing number of others, that won’t offer a job without background information. These companies see the cost as completely justified in comparison to the costs and time lost when the wrong person is hired.

As we look at security in the financial industry in this issue, Hi-Tech Security Solutions decided to speak to two of the preeminent local background screening companies for insights into what screening is advised for those working in the financial markets. As quickly became apparent, businesses from a variety of markets are making use of pre-employment screening, not only the financial market, while a growing number are also doing post-employment screening to make sure all’s well with their employees.

The people we approached for comment are:

• Jennifer Barkhuizen from Managed Integrity Evaluation (MIE), and

• Jenny Reid from iFacts.

Starting with the financial market, we asked what the benefits of screening employees in the financial industry would be and what risks can be mitigated by background screening?

“Fraud, corruption and misrepresentation within South Africa are widespread challenges that are reported in the media all too often,” says Barkhuizen. “Companies need to be more vigilant about the people they employ by making sure comprehensive and cost-effective background screening checks are conducted.

“Screening candidates within the financial services industry will not only ensure that your organisation keeps in line with regulatory changes, but that the best suitable and qualified person is hired for the position.”

She adds that if comprehensive background screening checks are not conducted within this sector, companies do not only face financial risks, but can also be impacted by potential reputation damage, should a poor hiring decision be made.

On the other hand, Reid believes that screening should not be for one industry alone. “I strongly recommend that each company addresses their risk by ensuring that their employee screening policy is approved by the following departments:

• Human resources

• Procurement

• Legal

“Then it should be presented to the executive board that should approve it. The reason for this is to ensure that there is buy in across the company and no one person or department bypasses the policy merely because they can.”

She adds that one of the checks that should be implemented, but cause some challenges is a credit check. The NCR recently changed regulations and now only positions of financial risk can be subjected to a credit check. Another common pre-employment check is a polygraph test.

“While I am a fan of these for investigation purposes, I believe that far more information can be obtained by doing the relevant integrity and behavioural assessments. The reason for this is that these tests can measure the possible intentions of the individuals as opposed to measuring their honesty about what they have done in the past. Many individuals do not know what their intention would be when they are exposed to syndicates and how they will react.”

Beating the degree mills

Given the ease with which false IDs are available in South Africa, how can companies make sure the people they hire are who they say they are or have the educational qualifications they claim?

The fact is that buying a qualification certificate online has unfortunately become relatively easy, especially with degree mills that continue to plague the market. As such, Barkhuizen says it is critical for businesses to make use of a reputable background screening and qualification verification company. “MIE has partnered with various accredited suppliers who we work very closely with to verify credentials of candidates.”

Reid adds that, in the past, the only way companies could verify the ID of an individual would be to check through the credit bureau and establish whether or not that ID had been used in questionable transactions. “Now some screening companies are able to verify the ID of the individual with the Department of Home Affairs and this should be an essential part of the screening policy.

“In addition to verifying the ID, companies should have reference checks done via an independent party and proper questioning and verification of the referee should be done. Sadly we see many companies set up to create CVs and they also provide the reference checks etc.”

In terms of qualifications, iFacts is pleased to see that the government is taking this matter seriously and is setting a legal system in place to convict people for lying about qualifications on their CVs, Reid continues. “It was most interesting recently to read a string of comments on a news article about this new law and see how people openly admit to lying on their CV. It is not uncommon and companies should not take any information on a CV at face value. A reputable independent employee screening company will know where to get the verification of the degree done.”

With regards to qualification verifications, MIE owns and operates the National Qualifications Register (NQR) which is used to verify qualifications accurately and efficiently from subscribing institutions. Should a result not be found on the NQR, MIE contacts the institution where the qualification was obtained from directly to verify the qualification.

Are your likes public?

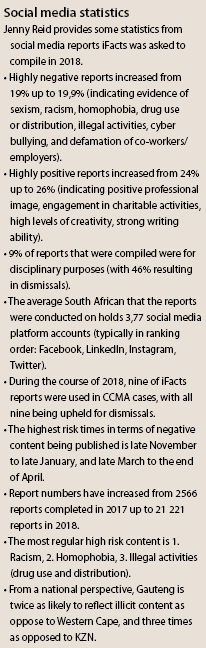

Many people think their social media posts are somehow personal and not open to the world. For the record, they are not. More importantly, more companies are doing social media risk assessments on employees to find out a bit more than what is on their CVs. Reid says social media risk assessments have been around for a few years and only a few enlightened companies are making use of them.

However there are those who would question the legality or ethics of ‘snooping’ on someone’s Facebook or Instagram.

“The vast majority of people are misinformed regarding ownership of social media accounts, content and posts,” explains Reid. “The reality is, social media accounts, content and activity follow the same principal as ID book, passports and drivers’ licences. We are merely the account holders, the moment we post anything on these profiles, the actual content is owned by the platform.

“Second to this, from a purely legal perspective, laws governing public domain apply to social media. Legally speaking, it is the user’s/account holder’s responsibility to set privacy levels to restrict content they want to remain private from being in the public domain.”

Barkhuizen agrees: “Social media profiles present a wealth of information on users and the analysis of this can be used to identify potential red flags around a candidate’s suitability to the business’s culture prior to, and post-appointment. It can also be leveraged to gain a deeper understanding of employees’ career and personal aspirations. Such data can then be mapped back to job roles or growth and development trajectories for improved employee satisfaction – which is known to have a significant impact on productivity.”

She adds that MIE has seen significant growth in social media screening requests and expects the demand for such requests to grow. However, consent is required locally, and it is not legal to request social media passwords from potential employees.

Supporting the privacy issue, Reid says in South Africa it is illegal to ask employees/ candidates to:

• Provide account log in details.

• Accept friend/connection or follow request.

• To log into accounts so the employer/potential employer can ‘look around’.

As to the question of ethics, Reid believes it is ethical. “The harsh reality is that individuals conduct their own version of social media screening in their everyday lives (when a person meets a new potential romantic partner, within the first 72 hours both parties would have closely scrutinised one another’s social media content and behaviour to gain insight and an understanding into the other person). If this practice is ethical for our everyday personal lives, why would it not be ethical for business purposes?”

Post-employment screening

While not the norm, we are seeing an increase in companies doing post-employment screening, especially for employees in sensitive or senior positions, as well as those involved in finances. “MIE does recommend undertaking the process of post-employment screening at regular intervals, as part of a company’s HR processes. This is for the purpose of ensuring that the company consistently manages its potential risk and should form part of a company’s risk mitigation strategy from a HR perspective,” notes Barkhuizen.

Reid also recommends ongoing screening, but says it is really only done for people in high-risk positions. “Again, this should be considered in line with the position and the risks related to it. It should also be considered in terms of the Labour Relations Act.

“An example here would be an employee has been convicted of a crime during his employ. If this is uncovered and is not relevant to the employee’s job description, the company may find themselves in a position where they have information that they cannot do anything with. We recommend that the action to be taken after disclosure (voluntarily or involuntarily) should be part of the company policy and should be disclosed to all employees.”

In addition, Reid says that social media risk assessments are highly recommended in terms of ongoing assessments.

The two commenters in this article are part of companies that offer screening services to their clients. It is, naturally, possible to do background screening for yourself, but then the company would have to have permanent staff to check all of the references, data provided and social media sites. A third party has the tools and expertise to do it quickly and accurately, and they keep abreast of the latest legal requirements and technical resources related to the screening discipline.

For more information, contact

• iFacts, +27 11 609 5124, jenny@ifacts.co.za, www.ifacts.co.za

• Managed Integrity Evaluation (MIE), +27 12 644 4000, jenniferb@mie.co.za, www.mie.co.za

| Tel: | +27 11 453 1587 |

| Email: | admin@ifacts.co.za |

| www: | www.ifacts.co.za |

| Articles: | More information and articles about iFacts |

© Technews Publishing (Pty) Ltd. | All Rights Reserved.