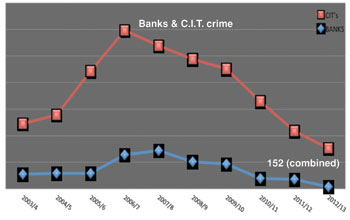

Since the days of rampant armed attacks on banks and cash in transit companies in the nineties, much has been done by these industries to harden their “targets”. So much so that the incident level dropped markedly as indicated in Graph 1.

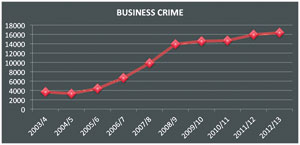

Graph 2 shows the trend on business crime over the same period.

With cash being the primary target of attacks, the demand for cash has never dissipated. Criminals simply moved their efforts to softer targets, such as the retailers and other business outlets.

It’s important to understand the key drivers of business attacks:

* 95% of business robberies are primarily for cash.

* As much as 93% of these are committed with insider participation.

* Criminals make it their business to know the security status of the stores they target and whether they are hardened or not.

The solution? Remove cash as a target.

Many retailers mistakenly believe that it is sufficient to implement a solution that meets the minimum requirements to insure cash against such an attack. What is often not understood is that the true risk lies in the attack itself and the enormous risks associated with the potential consequences thereof.

Customers and staff are negatively affected by an attack and this frightening experience extends out to the wider audience of their families and their community. There is an ever present risk to life and limb and the loss of trading for many months after such a traumatising event.

When a holistic cash management solution is installed, the primary goal should be to ensure that the risk of attack is reduced substantially. It is important for business owners to ask the question of their solution providers as to their risk profile as compared to leaders in the industry.

Criminals know your vulnerability scale, and if you’re simply meeting the minimum standards for cash insurance, you remain a target.

For more information contact Cash Connect Management Solutions, +27 (0)11 996 4411, info@cashconnect.co.za, www.cashconnectsus.co.za

© Technews Publishing (Pty) Ltd. | All Rights Reserved.